1887

New Oriental Bank opened but was closed in 1892. In 1885 the bank financed the construction of the Old Supreme Court Building

1894

A Government Savings Bank department operated by the Post Office was opened. The bank’s function focused on effecting government transactions (domestic and external), maintaining government accounts and acceptance of savings deposits from residents.

1911

The Bank of Mauritius opened a branch in Seychelles. It closed in 1916 when it was acquired by the Mercantile Bank of India Limited.

1936

Seychelles Currency Board established

1937

Seychelles Agricultural Bank was established and was later reconstituted in 1963.

1959

Launch of Barclays Bank in Seychelles – It was located at Beau Vallon

1968

Standard Bank (Standard Chartered Africa PLC) opened a branch in Victoria. It ceased operations in 1991 after a joint venture with Nouvobanq.

1970

Establishment of Seychelles Credit Union

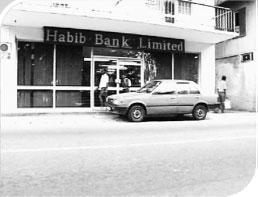

1976

Opening of Habib Bank Limited

1976

Bank of Credit and Commerce International (BCCI) was registered in Seychelles as an overseas company. In January 1986, it obtained its license to operate a branch in Victoria

1977

The Development Bank of Seychelles was created as a joint venture between the Government and other shareholders

December 1978

The Seychelles Monetary Authority (SMA) was established under the Seychelles Monetary Decree, 1978. It took over the responsibilities of the Seychelles Currency Board that was created in 1936. The SMA was dissolved in 1982 upon the establishment of the Central Bank of Seychelles.

1978

Opening of Banque Francaise Commerciale Océan Indien

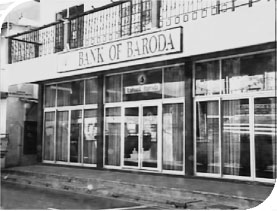

1978

Bank of Baroda was set up as a full-service bank in Seychelles

1978

Commercial Bank (Seychelles) limited started its operations… and ceased one year later.

1981

Seychelles Savings Bank started its operations

1982

Central Bank of Seychelles was established under the Central Bank of Seychelles Act of 1982.

1991

The Seychelles International Mercantile Banking Corporation (SIMBC), currently trading as Nouvobanq, started operation in Seychelles when it took over the assets of BCCI following its liquidation

1993

Nouvobanq introduced the first Automated Teller Machine (ATM) service called ‘Nouvocash’.

1996

SWIFT was introduced by the CBS as an international platform to facilitate cross border payments.

2003

The Mauritius Commercial Bank (MCB) (Seychelles) Ltd started operation in Seychelles. It also took over the assets of Banque Francaise Commerciale Océan Indien.

2003

Housing Finance Company Ltd was incorporated under the Companies Act, 1972

2005

Barclays Bank introduces payments through Point of Sale (POS).

2008

Bank Muscat International Offshore (BMIO) was set up as an offshore Bank.

2009

Launch of the CBS Immediate Transfer Service (CBSITS) which was operated via the SWIFT network to facilitate interbank fund transfers

2010

Launch of the first core banking system of the Central Bank of Seychelles.

March 2012

The Regulations on Credit Information System (CIS) was issued in March 2012. As of July 2012, it was mandatory for participating institutions to adhere to the regulations. The aim of this system is to allow the collection and exchange of credit and other relevant information amongst credit granting institutions.

August 2012

Launch of the Electronic Cheque Clearing (ECC) System to facilitate the electronic cheque clearing process using electronic cheque images transmitted between all banks and SCU for same day clearing.

July 2012

Barclays Bank (Seychelles) Limited offered fully fledged internet banking services for individual and commercial customers, thereby becoming the first local bank to offer a full functionality, on-line banking service. During the same year Barclays Bank introduced ATM bill payments to all debit card holders.

2013

The Seychelles Savings Bank was rebranded as the ‘Seychelles Commercial Bank’

August 2013

Launch of the Seychelles Electronic Funds Transfer (SEFT) System to facilitate electronic transfer of funds, in the local currency, between all banks and SCU.

2014

A branch of The Bank of Ceylon opened in Seychelles

March 2014

Barclays Bank (Seychelles) Limited launched the first mobile banking app in Seychelles.

2014

Foreign financial institution, Bank Al Habib Limited (BAHL), start operations. BAHL closed its branch in 2021

2016

BMIO was taken over and renamed Al-Salam Bank Seychelles

November 2017

Cash accepting devices (CAD) enabled ATMs were introduced by Barclays Bank (Seychelles) Limited.

March 2018

SWIFT Sanctions Screening System went live. This system automatically screens the CBS’ financial transactions against international sanctions lists and flags suspicious activities.

December 2018

The SEFT system was upgraded and was made available to the public to initiate online payments without the need to physically visit their banks

2019

Licensed in 2016, The State Bank of Mauritius opened its branch in August 2019. It closed in 2020

2019

Habib Bank Limited closed its branch in Seychelles

2020

Barclays Bank (Seychelles) Limited rebranded to Absa Bank (Seychelles) Limited

November 2020

Launch of the SWIFT Basic Tracker tool. This allowed for all SWIFT customer payments to be tracked end-to-end in real time by providing the status confirmation for each and every customer payment transaction.

May 2021

Launch of Collateral Database Registry – a centralised, electronic public database providing for a more streamlined registration of movable collaterals

December 2021

Launch of first touch-free ATM service or cash withdrawal service through the use of QR codes by Absa Bank (Seychelles) Limited to provide cardless and contactless cash withdrawal capability to customers.

May 2024

Launch of the digital wallet app (Absa Spark) by Absa Bank (Seychelles) Limited.